Weekly Market Recap Despite some early jitters due to talk of new U.S. tariffs on a couple of our country’s largest trading partners, stocks ended the week relatively flat with gains in the tech sector offsetting an overall mid decline in the broader markets. A mix of good economic news helped buoy optimism as retail sales were relatively strong … Read More

Weekly Market Insights 07/14/2025

Weekly Market Recap Stocks ended last week slightly lower, with the Dow Jones down 1.0%, while the tech heavy S&P 500 and Nasdaq indices barely budged. Despite the pullback, major indexes hovered near record highs set earlier in the week or the previous week. The primary driver was renewed trade tensions after the U.S. announced new tariffs on more … Read More

Monday Morning Brief – 3/18/2024

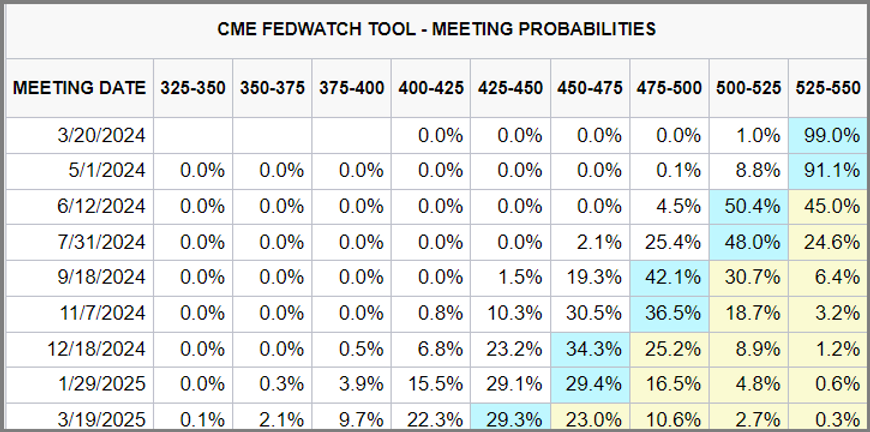

Weekly Economic Insights Stocks rallied to new highs early last week before lackluster retail sales, higher-than-expected inflation, and “hot” labor market readings poured a little cold water on the rally. The data points below dampened investor sentiment towards the possibility of a June rate cut, and all but eliminated any hopes for cuts in May as witnessed in the following … Read More

Monday Morning Brief

Stocks posted another good week with the S&P 500 up 1.06% on Solid economic data with a relatively calm in the bond market. Relative being the key word here amidst all the interest rate volatility of late, but the 10 year yield “only” moved up 14 bps from the prior week’s close and trading was contained inside the prior week’s … Read More

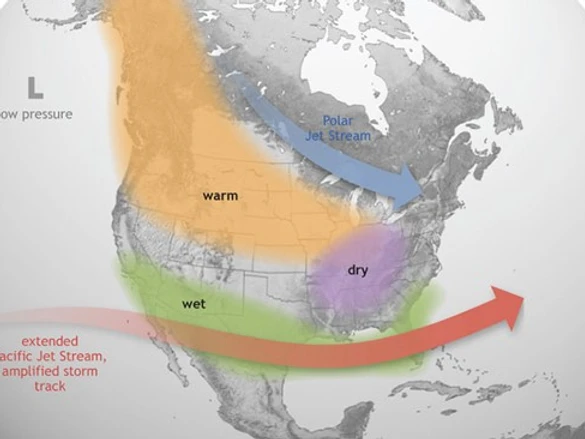

Snowflakes and the Stock Market, Q4 Rally Begins

If you’ve spent more than 10 minutes with me, you likely know that winter is my favorite season of the year. Don’t get me wrong, I enjoy a beautiful summer day on the ocean, but I dream of powder covered snow fields. My snow obsession starts to kick in around October every year and by November, I am fully engaged… … Read More